Amazon is the better choice if you want global reach and advanced logistics in 2026. Walmart is the better option if you’re focused on the US market and want lower fees with less competition.

Many sellers struggle with this decision. Amazon provides you with an international scale, millions of shoppers, and a powerful fulfillment network through FBA. The trade-off is higher costs and crowded competition.

Walmart, on the other hand, connects you with 150 million weekly US shoppers, doesn’t charge a monthly seller fee, and offers more space in product categories. But its marketplace is still mainly limited to the United States. The question isn’t just which platform is bigger, it’s which one fits your business goals.

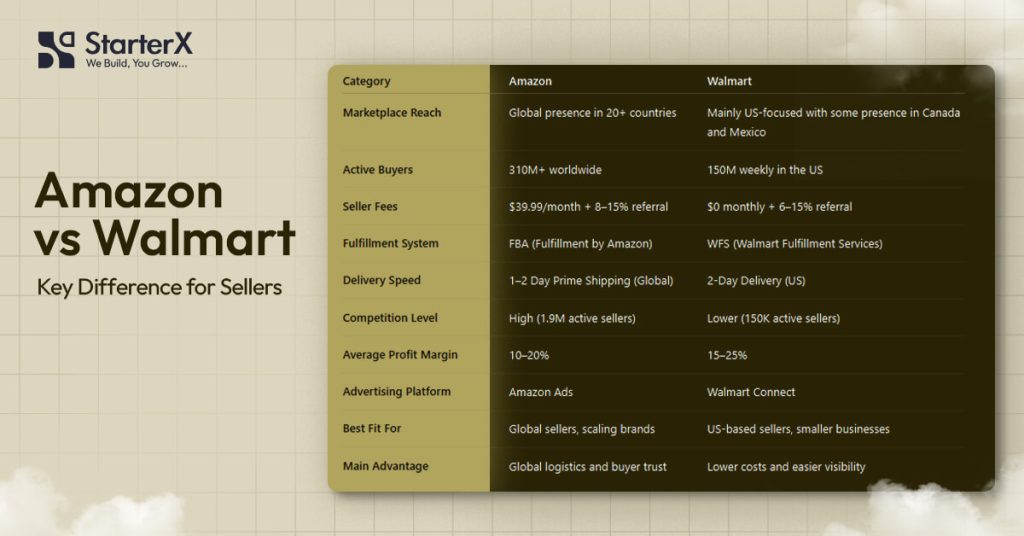

Here’s a quick side-by-side look at both marketplaces in 2026:

| Factor | Amazon | Walmart |

| Active Buyers | 310M+ worldwide | 150M weekly (US-focused) |

| Monthly Fees | $39.99 subscription | $0 subscription |

| Fulfillment | Global FBA network | US-focused WFS |

| Competition | 9.7M sellers, high saturation | 150K sellers, lower saturation |

| Best For | Global reach, scale, logistics | US sellers, visibility, margins |

Key Takeaways:

- Amazon dominates globally with over 310 million active buyers and advanced FBA logistics, making it ideal for international sellers.

- Walmart leads in the US with 150 million weekly shoppers and no monthly seller fees, offering higher visibility and less competition.

- Amazon charges higher fees but provides Prime trust and worldwide reach.

- Walmart has lower costs and works best for US-based businesses seeking stronger margins.

- Amazon Ads outperform globally, while Walmart Connect delivers cost-effective US targeting.

- Profit margins vary: Amazon offers scale, Walmart favors smaller sellers in America.

- Best choice depends on goals: choose Amazon for global expansion, Walmart for US-focused growth.

At StarterX, we are a full-service e-commerce agency that lives and breathes e-commerce. We’ve built and managed stores for clients on both Amazon and Walmart, helping them scale successfully on each platform. Because we work across both marketplaces every day, we know their strengths, their limits, and what really drives results for sellers in 2026.

Now that you’ve seen the big picture, let’s get started.

Table of Contents

ToggleHow do Walmart and Amazon compare in marketplace size in 2026?

Amazon is larger in the global marketplace size in 2026, while Walmart holds a stronger position in the United States.

Amazon reports more than 310 million active buyers worldwide, supported by marketplaces in over 20 countries. Its reach extends across North America, Europe, and Asia, giving sellers access to international audiences that Walmart cannot match.

Walmart attracts about 150 million weekly shoppers in the US, a number that combines both its online marketplace and retail stores. While Walmart’s international footprint is growing in Canada and Mexico, its main strength is still within the American market.

| Platform | Active Buyers 2026 | Geographic Reach | Growth Focus |

| Amazon | 310M+ worldwide | 20+ countries | Global scale |

| Walmart | 150M weekly US | US, Canada, Mexico | North America |

For sellers, this size comparison means:

- Amazon is best if you want to sell across multiple regions and expand internationally.

- Walmart is best if your products target American buyers and you want to benefit from strong retail integration.

In short, Amazon wins on a global scale, while Walmart wins on the US market depth.

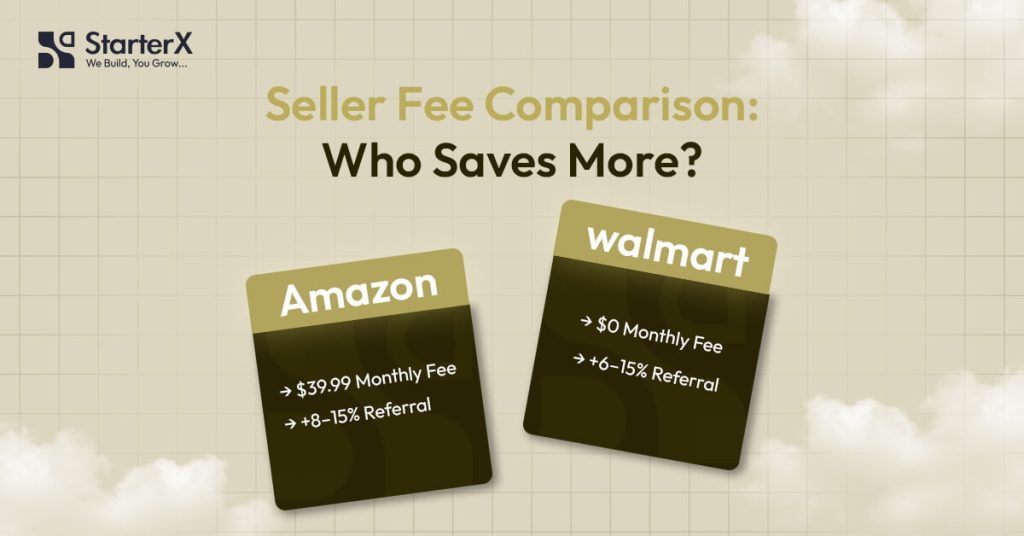

Which marketplace charges lower seller fees in 2026?

Walmart charges lower seller fees in 2026, while Amazon has higher overall costs for sellers.

Amazon sellers pay a monthly subscription fee of $39.99, plus referral fees that range from 8% to 15% depending on the category. Sellers using Fulfillment by Amazon (FBA) also pay storage and fulfillment costs, which can significantly reduce margins if products move slowly.

Walmart does not charge a monthly subscription. Instead, it applies only referral fees between 6% and 15%, depending on the category. Sellers who use Walmart Fulfillment Services (WFS) pay storage and shipping costs, but overall expenses remain lower than Amazon for most categories.

| Fee Type | Amazon Sellers (2026) | Walmart Sellers (2026) |

| Subscription | $39.99/month | $0/month |

| Referral Fees | 8–15% per sale | 6–15% per sale |

| Fulfillment | FBA fees (varies by size/weight) | WFS fees (varies by size/weight) |

| Other Costs | Closing fees, storage, ads | Storage, ads |

For sellers:

- Amazon is more expensive, but offers advanced fulfillment and Prime trust.

- Walmart is cheaper to start on, with no subscription and lower competition.

In short, Walmart wins on cost savings, while Amazon justifies its higher fees with scale and logistics.

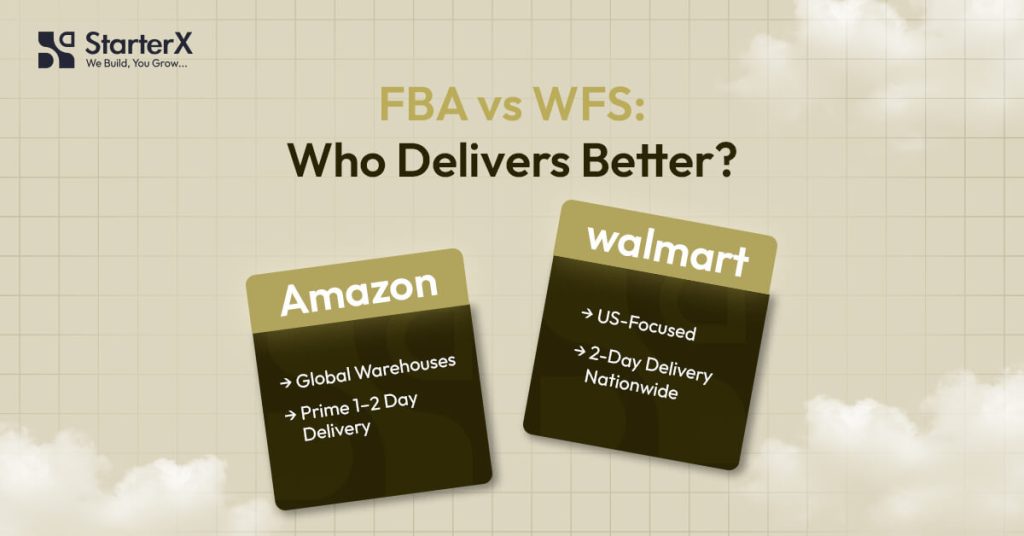

Which marketplace offers stronger logistics and fulfillment in 2026?

Amazon offers stronger logistics in 2026 through its global FBA network, while Walmart provides solid but US-focused fulfillment with WFS.

Amazon has built one of the most advanced fulfillment systems in the world. Sellers using Fulfillment by Amazon (FBA) benefit from fast Prime shipping, global warehouse coverage, and automated returns handling. This infrastructure allows Amazon sellers to reach buyers in more than 20 countries, which makes it a strong foundation for starting an Amazon FBA wholesale business at scale.

Walmart Fulfillment Services (WFS) continues to expand, but its coverage is still focused on the United States. WFS provides two-day delivery for US shoppers, competitive storage rates, and integration with Walmart’s retail presence. For sellers targeting American customers, WFS offers reliability without the monthly subscription costs.

| Feature | Amazon FBA (2026) | Walmart WFS (2026) |

| Geographic Reach | 20+ countries | Primarily US |

| Delivery Speed | Prime 1–2 days (global) | 2-day delivery (US) |

| Return Management | Fully managed | Managed within US |

| Integration with Stores | Online marketplace only | Online + physical stores |

| Cost Level | Higher overall | Lower for US sellers |

For sellers:

- Amazon is best if you need international reach and Prime-level delivery.

- Walmart works better if you focus only on US customers and want lower fulfillment costs.

In short, Amazon wins globally on logistics, while Walmart provides a strong US-centered alternative.

To maximize these benefits, our Amazon agency helps sellers set up, optimize, and scale their FBA operations for faster growth.

Where do new sellers get better visibility in 2026?

Walmart gives new sellers better visibility in 2026 because competition is lower than on Amazon.

Amazon has more than 9.7 million registered sellers, with about 1.9 million active. This creates intense competition, especially in popular categories like electronics, beauty, and fashion. New sellers often struggle to win the Buy Box or gain organic rankings without heavy investment in ads.

Walmart’s marketplace is much less saturated, with around 150,000 active sellers. Categories are less crowded, giving new sellers a better chance to appear in search results and capture visibility faster when they understand how to sell on Walmart Marketplace.

| Factor | Amazon (2026) | Walmart (2026) |

| Active Sellers | 1.9M active (9.7M registered) | ~150K active |

| Competition Level | Very high, saturated | Lower, more space |

| Buy Box Difficulty | Hard for new sellers | Easier with fewer competitors |

| Visibility Growth | Slower without ads | Faster, especially in niche categories |

For sellers:

- Amazon requires strong advertising budgets and optimized listings to gain early traction.

- Walmart offers quicker visibility for new sellers, especially in less saturated categories.

In short, Walmart is friendlier for new sellers, while Amazon rewards established brands with resources.

If you want to take advantage of this opportunity, our Walmart agency provides complete support to launch and grow your store with stronger visibility in Walmart’s marketplace.

Which marketplace provides more trust and buyer protection?

Amazon provides stronger buyer protection in 2026, while Walmart builds trust through pricing and retail presence.

Amazon’s A-to-Z Guarantee covers customers against delivery issues, product defects, and poor service. Combined with Prime shipping reliability, this system makes buyers feel secure, especially in international markets where trust is critical.

Walmart focuses on transparent return policies, everyday low prices, and integration with physical stores. US shoppers often prefer Walmart for household goods because they can return products easily in-store. This mix of online and offline trust strengthens Walmart’s position with American buyers.

| Trust Factor | Amazon (2026) | Walmart (2026) |

| Buyer Guarantee | A-to-Z Guarantee | Standard return policies |

| Return Options | Online, mail, global | Online + in-store (US) |

| Brand Perception | Trusted globally | Trusted strongly in the US |

| Shipping Reliability | Prime network, global | 2-day US delivery, retail backup |

For sellers:

- Amazon offers stronger global trust through its guarantee and Prime reputation.

- Walmart builds buyer confidence in the US with easy returns and retail integration.

In short, Amazon leads in international buyer protection, while Walmart wins American trust through convenience.

Which marketplace is better for international expansion in 2026?

Amazon is better for international expansion in 2026, while Walmart remains mostly focused on North America.

Amazon operates in more than 20 global marketplaces, including the US, Canada, Mexico, UK, Germany, Japan, and Australia. Sellers can scale into multiple regions using Amazon Global Selling, supported by FBA’s international logistics and cross-border shipping tools. This makes Amazon the top choice for businesses planning to reach buyers worldwide.

Walmart’s marketplace is still concentrated in the US, Canada, and Mexico. While Walmart has a strong retail presence, its online marketplace has not expanded to the same international level as Amazon. Sellers relying on Walmart are limited mainly to North American audiences.

| Factor | Amazon (2026) | Walmart (2026) |

| Countries Available | 20+ | 3 (US, Canada, Mexico) |

| Global Shipping Tools | Amazon Global Selling, FBA | Limited, mostly US-based |

| Expansion Potential | High, multi-continent | Low, North America-focused |

| Best For | Global sellers | US and regional sellers |

For sellers:

- Amazon enables international growth with proven infrastructure and global demand.

- Walmart is reliable for US-focused sellers but limited in global reach.

In short, Amazon wins for global expansion, while Walmart is a regional player.

How do profit margins compare between Walmart and Amazon sellers?

Walmart sellers often achieve higher profit margins in 2026, while Amazon sellers rely on scale to maximize earnings.

Amazon’s fees and advertising costs cut into margins, especially for new sellers. Referral fees, FBA storage, and fulfillment expenses often reduce net profit percentages. Many Amazon sellers report average profit margins between 10% and 20%, depending on category and ad spend.

Walmart has lower costs because it does not charge a monthly subscription and faces less seller competition. This allows sellers to keep more revenue per sale. Many Walmart sellers report margins between 15% and 25%, especially in household goods and niche categories with less price pressure.

| Factor | Amazon Sellers (2026) | Walmart Sellers (2026) |

| Average Profit Margin | 10–20% | 15–25% |

| Cost Pressure | High (fees, ads, storage) | Moderate (mainly referral + WFS) |

| Volume Potential | Very high, global | Lower, mainly US |

| Margin Stability | Lower with competition | Higher in less crowded niches |

For sellers:

- Amazon favors high-volume sellers who can absorb costs and scale globally.

- Walmart favors smaller or US-focused sellers looking for stronger margins per sale.

In short, Amazon wins on volume, while Walmart wins on margins.

Which marketplace drives higher advertising ROI in 2026?

Amazon Ads deliver stronger global ROI in 2026, while Walmart Connect offers cost-effective advertising for US sellers.

Amazon Ads is highly developed, with Sponsored Products, Sponsored Brands, and DSP for programmatic campaigns. With millions of active buyers worldwide, Amazon Ads drives high conversions, but the average cost-per-click has increased, making advertising more expensive for competitive categories.

Walmart Connect is smaller but cost-efficient. With fewer sellers and less competition for ad space, CPC rates are lower. Walmart also leverages in-store data from its physical retail network, helping sellers reach American buyers effectively at a lower cost than Amazon.

| Factor | Amazon Ads (2026) | Walmart Connect (2026) |

| Reach | Global, millions of buyers | US-focused, retail + online data |

| Ad Formats | Sponsored Products, Brands, DSP | Sponsored Products, Display, In-store integration |

| Cost-per-click | Higher, competitive | Lower, less competitive |

| ROI Potential | Strong with scale | Strong for US-focused sellers |

For sellers:

- Amazon Ads is the best choice for global campaigns and advanced targeting.

- Walmart Connect works best for US sellers seeking lower costs and retail-powered visibility.

In short, Amazon wins globally with scale, while Walmart delivers higher ROI for US-focused advertising.

Which marketplace aligns better with niche product strategies?

Walmart supports niche sellers with lower competition, while Amazon provides broader exposure but higher saturation.

Amazon has categories for nearly every product type, from electronics to handmade goods. This variety gives niche products access to global audiences. However, competition in most categories is intense. Standing out often requires heavy investment in advertising, optimized content, and strong branding.

Walmart’s marketplace is smaller, which means niche categories are less crowded. Sellers offering unique or specialized products often find faster visibility because there are fewer direct competitors. For example, niche household products or regional food items can perform better on Walmart due to its integration with US retail shoppers.

| Factor | Amazon (2026) | Walmart (2026) |

| Category Coverage | Very broad, global | Narrower, mainly US demand |

| Competition Level | High in most categories | Lower, more room to stand out |

| Advertising Needs | Essential for visibility | Lower investment needed |

| Best For | Global niche scaling | US-focused niche growth |

For sellers:

- Amazon is best for niche brands that want worldwide exposure.

- Walmart is best for niche products targeting American shoppers with less competition.

In short, Amazon suits global niche brands, while Walmart is ideal for smaller niche sellers in the US.

Key Recommendations for Sellers in 2026

- Choose Amazon if your goal is global expansion with advanced fulfillment and worldwide buyer access.

- Choose Walmart if you want lower costs, faster visibility, and stronger margins in the US market.

- Use Amazon Ads for global reach, but consider Walmart Connect for cost-effective US targeting.

- Evaluate your goals first: international scale favors Amazon, while US-focused growth favors Walmart.

Get Expert Guidance Before You Start

If you want to start your e-commerce business but still feel unsure about which marketplace fits your goals, we can help. At StarterX, our experts have built successful stores on both Amazon and Walmart. We’ll guide you through fees, logistics, advertising, and growth strategies so you can launch with confidence.

Get your FREE Consultation now and let us help you build a profitable e-commerce business.

FAQs About Selling on Walmart vs Amazon

Can I sell on both Walmart and Amazon at the same time?

Yes, many sellers operate on both marketplaces. Using both helps diversify revenue, balance global and US-focused sales, and reduce dependence on a single platform.

Which marketplace is easier to get approved on in 2026?

Amazon’s registration is faster, but competition is higher. Walmart’s approval process is stricter and requires proof of business credibility, yet the reward is fewer crowded categories.

Do Walmart or Amazon offer better customer service support for sellers?

Amazon offers dedicated seller support with its Seller Central and FBA services. Walmart provides account managers for some sellers, but has fewer support resources compared to Amazon.

How important are product reviews on each marketplace?

On Amazon, reviews heavily influence rankings and conversions. Walmart reviews also matter, but lower competition means sellers can gain traction with fewer reviews compared to Amazon.

Which marketplace is better for brand building in 2026?

Amazon offers more tools for branding, such as A+ Content, Brand Stores, and Amazon Ads. Walmart has fewer branding features, but sellers benefit from its strong retail reputation in the US.

Is inventory management different between Walmart and Amazon?

Yes. Amazon requires strict inventory compliance under FBA, with storage limits and fees for slow-moving products. Walmart’s WFS is more flexible but operates mainly in the US.

Can I use third-party tools to manage both marketplaces?

Yes. Tools like Helium 10, Jungle Scout, and Linnworks help sellers manage listings, inventory, and ads across both Amazon and Walmart from a single dashboard.

Which marketplace is better for seasonal products in 2026?

Amazon works better for global seasonal demand like holidays, Prime Day, and international events. Walmart is strong for US-based seasonal peaks such as Thanksgiving and back-to-school shopping.

The StarterX Team is a group of e-commerce experts with years of hands-on experience in launching, managing, and scaling online businesses. As trusted authorities in the e-commerce space, we’ve helped entrepreneurs grow successful stores on Amazon, Shopify, TikTok, and Walmart. Backed by real-world results and a data-driven approach, we deliver proven strategies and insights you can trust to succeed in the digital marketplace.