To set up an Amazon Seller account, go to sell.amazon.com, sign in or create an account, choose your account type, enter your business and tax details, upload valid identification, and complete Amazon’s verification process.

Over 60% of products sold on Amazon are from third-party sellers, and more than 500,000 new sellers sign up globally each year. Whether you’re starting a side business or launching a full online store, Amazon gives you access to a marketplace with over 300 million active customers.

The setup process is simple when you’re prepared. You’ll need a credit card, a bank account, a government-issued ID, and tax information. Most new sellers can finish the registration in under 30 minutes if their documents are ready.

This beginner’s guide is written to help you get started quickly and confidently. You’ll find clear steps, real examples, and practical tips to avoid delays or account issues.

Key Takeaways:

- You can start at sell.amazon.com with a personal or business email.

- Individual accounts are best for low volume; Professional accounts unlock more tools.

- You must submit valid ID, bank details, and tax info for approval.

- Most accounts are verified within 24–48 hours if no issues are found.

- Errors like mismatched names or unclear documents can delay your setup.

Table of Contents

ToggleWhat Do You Need to Create an Amazon Seller Account?

To create an Amazon Seller account, you need a valid ID, a credit card, a bank account, tax information, and a phone number. All details must match the name and address on your documents.

Amazon uses this information to verify your identity, process payments, and confirm tax status. Incomplete or mismatched data often leads to registration delays or rejections.

Required Documents and Information Checklist

| Requirement | What It Must Include | Accepted Formats |

| Government-issued ID | Name, date of birth, clear photo | Passport, national ID, driver’s license |

| Bank account | Must be in your name or business name | Local or international bank accounts |

| Credit card | Must be chargeable for the identity check | Visa, MasterCard, Amex, etc. |

| Tax information | Country-specific tax ID or number | SSN, EIN (US); VAT (EU); PAN (India) |

| Phone number | Must support SMS or calls for 2-step verification | Mobile or landline |

| Business info | Legal name, business address (for registered businesses only) | Must match official registration |

Important Notes:

- All documents must be valid, unaltered, and clearly scanned in color.

- The name on your ID and bank account must match your Amazon registration exactly.

- Business sellers must also upload company registration documents (e.g., certificate of incorporation).

Tip: Use the same email and business details across all documents to avoid triggering Amazon’s fraud detection system.

Which Type of Amazon Seller Account Should You Choose?

You should choose a Professional account if you plan to sell more than 40 items per month or want access to business tools. Choose an Individual account if you’re selling occasionally and want to avoid monthly fees.

Amazon offers two main account types: Individual and Professional. Each is designed for different selling needs, and the right choice depends on your sales volume and goals.

Key Differences Between Individual and Professional Accounts

| Feature | Individual Account | Professional Account |

| Monthly Fee | None | $39.99 (USD) |

| Per-item Fee | $0.99 per item sold | No per-item fee |

| Product Listing Volume | Manual listing, one by one | Bulk upload tools are available |

| Buy Box Eligibility | Not eligible | Eligible |

| Access to Amazon Ads | No | Yes |

| Advanced Reports | No | Yes |

| Ideal For | Casual or new sellers | Brands, wholesalers, and high-volume sellers |

When Should You Choose a Professional Account?

Choose a Professional Seller account if:

- You sell more than 40 units/month

- You need inventory management or bulk listing tools

- You want to be eligible for the Buy Box

- You plan to use Amazon FBA or advertising features

- You operate as a registered business

When Should You Choose an Individual Account?

Choose an Individual Seller account if:

- You sell less than 40 units/month

- You want to test Amazon without monthly fees

- You don’t need access to ads or advanced reports

- You’re selling as a hobby or side project

Tip: You can upgrade from Individual to Professional anytime in Seller Central.

How to Register an Amazon Seller Account Step-by-Step?

To register an Amazon Seller account, go to sell.amazon.com, click “Sign up,” sign in or create a new Amazon account, then follow the seller onboarding process by submitting all required personal, business, tax, and banking information.

Amazon uses this process to verify your identity, approve your merchant profile, and grant access to Seller Central, where you can manage product listings, payments, and performance metrics.

Step 1: Go to the Amazon Seller Registration Page

Visit sell.amazon.com and click “Sign up.” This redirects you to Amazon Seller Central, the platform where sellers manage inventory, pricing, fulfillment, and customer service.

You can either:

- Use your existing Amazon customer login, or

- Create a new business email account for selling purposes

Step 2: Select Business Type and Country

Choose your seller type. Options include:

- Individual (for casual or hobby sellers)

- Privately-owned business (LLC, sole proprietorship, corporation)

- Publicly-owned business

- Charity

- State-owned enterprise

Then, select the country where your business is legally registered. This determines your compliance requirements, available marketplaces, and tax regulations.

Step 3: Enter Legal Business and Personal Details

Amazon collects data to verify both you and your business entity. You must provide:

- Legal name (as it appears on tax or ID documents)

- Business address (must match utility bill or bank statement)

- Phone number (for two-step authentication)

- Email address (used for notifications and buyer communication)

- Date of birth and place of birth (for KYC compliance)

Ensure all information matches exactly across documents. Any mismatch can delay account approval.

Step 4: Add Payment and Billing Information

Amazon requires a valid credit or debit card that can be charged internationally. This card is used for:

- Monthly subscription fees (if on a Professional plan)

- Refundable verification charges

- Future advertising costs (if you enable Sponsored Products)

You’ll also need to add a bank account where Amazon can send your payment disbursements. Use an account that supports local currency payments, or set up a global bank account via services like Payoneer or Wise if your local account isn’t supported.

Required attributes:

- Bank account holder’s name

- Bank account number (IBAN or local format)

- Bank address and SWIFT/BIC code (for international sellers)

Step 5: Complete the Tax Interview

You’ll be required to complete a tax interview, which determines your withholding tax obligations and allows Amazon to generate the correct tax forms.

- U.S. sellers must submit their SSN or EIN using a W-9 form

- Non-U.S. sellers must complete a W-8BEN or W-8BEN-E, depending on business structure

- European sellers may also need to submit a valid VAT number for EU marketplaces

The tax interview is completed directly inside Seller Central and takes less than 10 minutes.

Step 6: Upload Verification Documents

Amazon will ask you to upload scanned copies of documents for identity and address verification.

You must submit:

- A government-issued ID (passport, national ID, or driver’s license)

- Must be valid, not expired, and clearly legible

- Both front and back sides, if applicable

- A bank account statement or utility bill

- Must show full name, matching address, and be dated within the last 90 days

- Acceptable documents: electricity bill, water bill, internet bill, or official bank statement

All documents must be in color, in PDF, JPG, or PNG format, and written in English or with a certified translation.

Step 7: Complete Identity Verification (Video Call)

Depending on your location, Amazon may require a video verification call. During the call, an Amazon associate will:

- Ask you to show your original ID

- Confirm your name and date of birth

- Review your documents in real time

- Ask you to turn your head or show the document under different lighting for authenticity

You must have a webcam, a quiet space, and original documents on hand during this session.

This step ensures that the account owner is a real person, helping Amazon prevent fraud and fake sellers.

Step 8: Submit and Wait for Account Approval

Once all steps are completed, Amazon will review your application. Most seller accounts are approved within 24 to 72 hours.

You’ll receive an email confirming:

- Approval (with login access to Seller Central), or

- A request for additional documents

Note: If your application is rejected, Amazon usually gives a reason and a chance to re-upload or correct the information.

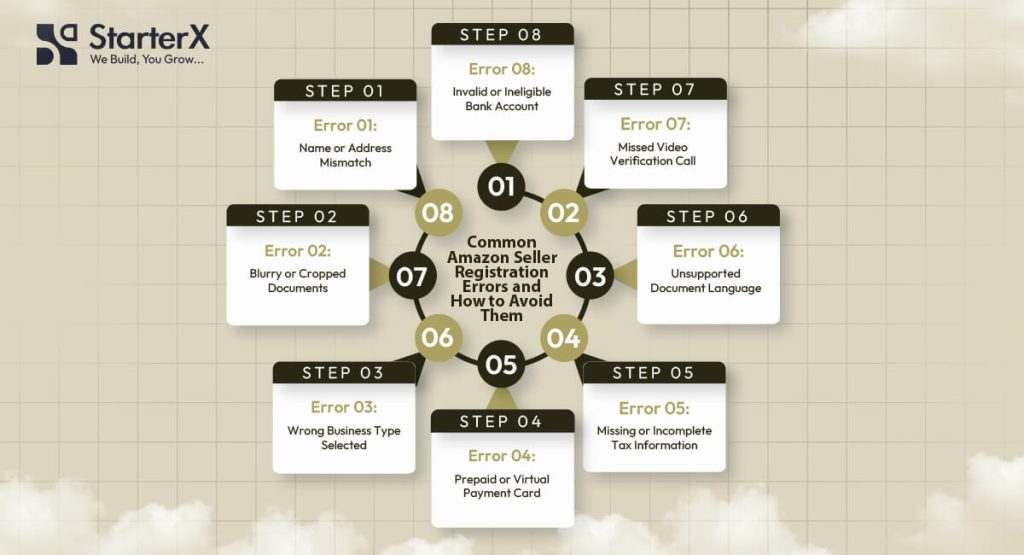

How to Avoid Common Registration Errors?

To avoid registration errors on Amazon, you must submit valid documents, ensure name and address consistency, select the correct business type, and follow Amazon’s ID verification guidelines exactly.

Most new sellers experience delays or rejections due to avoidable mistakes during the onboarding process. Amazon’s verification system is strict, and even minor mismatches can lead to account denial or long review times.

Below are the most common issues and how to avoid them.

1. Name or Address Mismatch Between Documents

Problem: Your legal name or address differs across your ID, bank statement, or registration form.

Why it matters: Amazon uses automated KYC checks. Any inconsistency between your uploaded documents and form entries triggers a manual review or rejection.

How to avoid it:

- Use your exact full legal name everywhere

- Avoid using abbreviations (e.g., “St.” vs. “Street”)

- Ensure your bank statement or utility bill has the same address as your Amazon profile

- If registering a business, use the registered company name exactly as it appears in your legal documents

2. Submitting Blurry or Incomplete Documents

Problem: You upload a low-resolution or cropped scan of your ID or proof of address.

Why it matters: Amazon’s system needs to read names, numbers, and expiration dates clearly for verification.

How to avoid it:

- Upload color scans in high resolution (300 DPI or higher)

- Ensure the entire document is visible, including all corners

- Use PDF, JPG, or PNG formats

- Do not mark or redact anything

Accepted documents: Passport, national ID card (front and back), utility bill, bank statement

3. Wrong Business Type Selection

Problem: You select the wrong entity type during registration.

Why it matters: If you register as a business but submit personal bank details or ID, your application may be flagged.

How to avoid it:

- If you run a registered company, select Business and submit official documents (certificate of incorporation, business license)

- If you’re an individual, select Individual and submit your personal ID and personal bank account

- Don’t switch types mid-process unless advised by Amazon

4. Using a Prepaid or Virtual Card

Problem: You add a payment method that Amazon cannot charge or validate.

Why it matters: Amazon tests your card during registration to validate your billing method.

How to avoid it:

- Use a real credit or debit card (Visa, Mastercard, Amex)

- The card must support international transactions

- It should not be prepaid, gift, or virtual-only

- The name on the card should match your Amazon account holder’s name

5. Missing or Incomplete Tax Information

Problem: You skip or incorrectly fill out the tax interview.

Why it matters: Tax compliance is mandatory. Incomplete or incorrect entries may pause the approval process.

How to avoid it:

- U.S. sellers must enter a valid SSN or EIN for the W-9

- Non-U.S. sellers must complete a W-8BEN or W-8BEN-E

- Use legal names and registered addresses exactly as they appear in government records

- Make sure your VAT or GST number is valid if registering in Europe, UK, or India

6. Document Language Not Supported

Problem: You upload ID or proof of address in a language Amazon does not support.

Why it matters: Amazon requires English or certified translations for all documents.

How to avoid it:

- Upload documents in English

- If not available, provide a certified translation

- Combine original + translation into one PDF if needed

7. Skipping Video Verification or Missing the Call

Problem: You ignore the identity verification call or miss your appointment.

Why it matters: Amazon may cancel your application if you don’t complete the live check.

How to avoid it:

- Be ready for a live video verification

- Use a laptop or phone with a working camera

- Have your original ID on hand

- Complete the call in a quiet, well-lit room

8. Using an Inactive or Ineligible Bank Account

Problem: Your payout account cannot receive payments or is under another name.

Why it matters: Amazon verifies payout accounts before disbursing funds.

How to avoid it:

- Use a personal or business bank account that matches the registration details

- Ensure the account supports incoming international transfers

- If local banking isn’t supported, use an Amazon-approved partner like Payoneer or Wise

What Countries Are Eligible to Sell on Amazon?

Amazon allows sellers from over 100 countries to register, provided they meet identity, banking, and tax compliance requirements. Eligibility depends on your country of residence, ability to receive payments, and access to required documents.

How to Check If Your Country Is Eligible

To verify if your country is supported by Amazon, visit the official help page here:

Amazon Global Selling – Country List

This list is updated regularly by Amazon and shows which countries can create seller accounts across Amazon marketplaces.

Core Requirements by Country

To be eligible, you must:

- Reside in an Amazon-approved country

- Have a valid government-issued ID

- Own a bank account that can receive international payments

- Provide a chargeable credit card

- Complete tax and identity verification in English or with a certified translation

- Accept Amazon’s seller terms and tax obligations per region

Examples of Eligible Countries

Here are some of the countries Amazon currently supports for seller registration:

| Region | Example Eligible Countries |

| North America | United States, Canada, Mexico |

| Europe | United Kingdom, Germany, France, Italy, Spain, Netherlands, Poland, Sweden |

| Asia-Pacific | India, Japan, Australia, Singapore, South Korea |

| Middle East | United Arab Emirates, Saudi Arabia |

| South America | Brazil |

| Africa | South Africa |

Note: Some regions may have access only to specific marketplaces (e.g. UAE sellers can only sell on Amazon.ae unless otherwise approved).

Common Limitations for Non-US Sellers

Even if your country is eligible, sellers outside the U.S. may face extra steps:

- You may need to open a global receiving account (e.g., Payoneer, Wise) if your local bank doesn’t support ACH or SEPA payments

- You must comply with local tax regulations like VAT, GST, or import-export laws

- Some countries require additional identity checks or notarized documentation

Countries That Are Not Eligible

Sellers from the following regions are currently not eligible to register:

- North Korea

- Iran

- Syria

- Sudan

- Crimea Region

- Any country under U.S. or UN trade sanctions

These restrictions are based on international compliance, banking limitations, and fraud prevention policies.

If your country is eligible and you meet all the document and banking requirements, you can register and sell on Amazon marketplaces worldwide.

Which Amazon Marketplaces Can You Sell On?

You can sell on multiple Amazon marketplaces using one seller account, depending on your account type, country of registration, and regional eligibility. Amazon groups its marketplaces into regions with shared dashboards and listing tools.

Amazon Marketplace Regions

Amazon operates over 20 global marketplaces. These are grouped into major selling regions:

| Region | Marketplaces Available |

| North America | United States (amazon.com), Canada (amazon.ca), Mexico (amazon.com.mx) |

| Europe | United Kingdom, Germany, France, Italy, Spain, Netherlands, Poland, Sweden, Belgium |

| Asia-Pacific | Japan, Australia, Singapore |

| Middle East | United Arab Emirates, Saudi Arabia, Egypt |

| South America | Brazil |

| India | India (amazon.in) – operates separately |

Unified Amazon Accounts: What Does That Mean?

A Unified Account gives you access to multiple marketplaces in the same region.

You can switch between countries using a single login on Seller Central.

Examples:

- A North America Unified Account lets you sell in the US, Canada, and Mexico

- A Europe Unified Account gives access to the UK, DE, FR, IT, ES, NL, SE, PL, and BE

You can manage listings, inventory, orders, and pricing per marketplace from one dashboard.

Can You Sell in All Regions from One Account?

Not by default. Access to additional regions like Asia-Pacific or the Middle East may require:

- Additional tax registration (e.g., VAT in the UK, GST in Australia)

- Approval for cross-border selling

- Local banking setup for payouts

- Fulfillment support (either FBA Export or third-party logistics)

To expand, use the Amazon Global Selling program, which supports international growth and compliance.

Do You Need Separate Listings for Each Marketplace?

Yes, listings are marketplace-specific. Each country has:

- Its own language

- Currency

- Shipping settings

- Tax requirements

Fulfillment and Currency Considerations

| Factor | Key Requirements |

| Currency Support | Must accept payments in the marketplace’s currency |

| FBA Access | Available regionally, FBA Export enables some international sales |

| Shipping Rules | Must follow local shipping times and rates |

| Customer Service | Required in marketplace language (use Amazon support if using FBA) |

Marketplace Expansion Tips

- Start with your home region (e.g., US if you’re based in the United States)

- Enable FBA Export to reach international buyers automatically

- Consider regional tax and customs laws before listing products abroad

- Use Marketplace Switcher in Seller Central to manage multi-country listings

With the right setup, one Amazon account can give you access to over 20 marketplaces across five continents.

What Are the Next Steps After Creating Your Seller Account?

After your Amazon Seller account is verified, your next steps include setting up store details, configuring tax and shipping settings, listing your first product, and ensuring your account is compliant and secure before selling.

You now have access to the full Seller Central platform. However, the account must be configured correctly to be fully operational and meet Amazon’s performance and policy standards.

1. Set Up Your Seller Account Information

Navigate to Settings → Account Info in Seller Central.

You must enter or confirm the following attributes:

- Business display name: This is what buyers will see on your listings

- Business address: Must match your registration documents

- Customer service email and phone: Required for FBM sellers

- Storefront link (if using Amazon storefront)

This data ensures buyer trust and supports compliance with local marketplace laws.

2. Configure Your Shipping and Fulfillment Method

Go to Settings → Shipping Settings and define how orders will be fulfilled.

For Fulfilled by Merchant (FBM):

- Create shipping templates by region

- Set handling time, transit time, and shipping rates

- Include return address and carrier details

For Fulfilled by Amazon (FBA):

- Enable FBA under Inventory → Manage FBA Shipments

- Create FBA-eligible SKUs and follow FBA prep and labeling requirements

- Generate shipping plans to send inventory to Amazon fulfillment centers

3. Add and Optimize Your First Product Listing

Use Inventory → Add a Product to list your first item.

If the product already exists in Amazon’s catalog, match the existing ASIN.

If it’s a new product, create a new listing using these attributes:

- Product title (up to 200 characters, keyword-optimized)

- Bullet points (5 required for Professional accounts)

- High-resolution images (at least 1000×1000 pixels)

- Product description and backend search terms

- Pricing, quantity, SKU, and product identifiers (UPC, EAN, GTIN)

Ensure your listing complies with category-specific listing guidelines and content policy.

4. Configure Tax Settings Based on Your Region

Navigate to Settings → Tax Settings and update your tax profile.

Depending on your selling region:

- US sellers: Activate Marketplace Tax Collection; no action needed for most states

- EU/UK sellers: Add VAT number; required to sell in most countries

- Indian sellers: Provide GST registration number

- Australia and Singapore: Submit local tax ID or GST number

Amazon uses this data to issue proper tax invoices, apply automated tax collection, and fulfill legal obligations.

5. Review and Confirm Your Payment Settings

Go to Settings → Deposit Methods and verify your bank account.

Make sure:

- The account supports currency payouts for your marketplace

- The name on the account matches your seller name or business registration

- The SWIFT/BIC and IBAN (for international sellers) are correct

Amazon disburses funds on a 14-day cycle, minus any applicable reserves or account holds.

6. Monitor Your Account Health from Day One

Amazon tracks performance using real-time metrics under Performance → Account Health.

Key performance attributes include:

| Metric | Threshold |

| Order Defect Rate (ODR) | Below 1% |

| Late Shipment Rate | Below 4% |

| Cancellation Rate | Below 2.5% |

| Tracking Validity | Over 95% |

Failing these thresholds can result in ASIN suppression or account suspension.

7. Enable Two-Step Verification and Seller Notifications

Secure your account with Two-Step Verification (2SV) under Login & Security.

Required options:

- Authenticator app or SMS verification

- Backup methods in case of device loss

Also, configure notification preferences to receive alerts for:

- Order updates

- Account warnings

- Customer inquiries

These settings ensure you never miss important operational or compliance-related events.

8. Activate Advertising Tools and Brand Protection Features

If you’re using a Professional account, you now have access to:

- Sponsored Products (Amazon PPC advertising)

- Coupons, promotions, and lightning deals

- Brand Registry (requires registered trademark)

- A+ Content and Storefront builder

If eligible, enroll your brand under Brand Registry via brandregistry.amazon.com

9. Read and Understand Selling Policies

Review Amazon’s official selling policies under Help → Policies and Agreements.

Focus on:

- Restricted product guidelines

- Condition guidelines (new, used, refurbished)

- Prohibited claims (e.g., health or safety-related claims)

- Customer communication policy (response times, tone, promotions)

Failure to follow these rules can lead to policy violations or account action.

By completing these steps, your account is fully ready to operate on Amazon. Focus on compliance, product quality, and performance from day one to avoid suspensions and build a healthy, scalable Amazon business.

Final Summary: Getting Started the Right Way on Amazon

Creating an Amazon Seller account is the first step to reaching millions of buyers. The process is straightforward when you prepare the right documents, follow Amazon’s verification requirements, and configure your account settings correctly.

Here’s a final checklist of what you’ve learned:

- Go to sell.amazon.com and register your account

- Choose the right seller plan: Individual or Professional

- Submit a valid ID, tax details, and a supported bank account

- Complete identity verification and wait for approval

- Set up Seller Central with shipping, tax, and listing configurations

- Create your first product listing and confirm the fulfillment method

- Monitor account health metrics and follow Amazon’s policies

- Enable security settings and explore advertising tools if eligible

Need help launching your store faster or getting expert guidance on your first listings?

StarterX helps new Amazon sellers with complete setup support, product listing optimization, and marketplace compliance, so you can avoid mistakes and start selling with confidence.

👉 Get Started with StarterX Now and streamline your Amazon launch the right way.

FAQs About Setting Up an Amazon Seller Account

Can anyone open an Amazon Seller account?

You can open an Amazon Seller account if you live in an eligible country, have valid identification, a chargeable credit card, a bank account that supports payments, and meet Amazon’s verification requirements.

What documents are required to register as an Amazon seller?

You need a government-issued ID, a recent bank statement or utility bill, a valid credit card, and tax information such as a VAT number, SSN, EIN, or GST, depending on your location.

How long does it take to get verified on Amazon?

Amazon typically completes seller account verification within 24 to 72 hours, but it may take longer if documents are unclear, inconsistent, or incomplete.

What is the difference between an Individual and a Professional Amazon seller account?

Individual accounts have no monthly fee but charge $0.99 per sale, while Professional accounts cost $39.99/month and include tools like bulk listings, advertising, and Buy Box eligibility.

Can I upgrade from an Individual to a Professional seller account later?

Yes, you can upgrade at any time through your Seller Central dashboard without creating a new account.

Do I need a business license to sell on Amazon?

You don’t need a business license to sell as an Individual. Business accounts must submit proof of business registration, such as a certificate of incorporation or tax ID.

Which countries are eligible to register as Amazon sellers?

Amazon supports seller registrations from over 100 countries. Eligibility depends on your ability to complete identity verification and receive international payments.

Can I sell in multiple Amazon marketplaces with one account?

Yes, Amazon Unified Accounts let you sell in multiple countries within a region, such as North America or Europe, using one Seller Central login.

Do I need to list my products in each marketplace separately?

Yes, each Amazon marketplace requires its own product listing due to language, currency, tax, and fulfillment differences. You can use Amazon’s Build International Listings tool to copy and manage listings.

What happens after my seller account is approved?

After approval, you can access Seller Central, configure your store, add your first product, choose a fulfillment method, and begin managing orders and payments.

How do I avoid common Amazon registration errors?

Use matching legal names across all documents, upload high-resolution color scans, select the correct business type, use a chargeable credit card, and attend any required video verification appointments.

Is Fulfillment by Amazon (FBA) available to new sellers?

Yes, new sellers can use FBA after registration. You must prepare products according to FBA guidelines and ship inventory to Amazon’s fulfillment centers.

When will I receive my first Amazon payment?

Amazon disburses payments every 14 days. You’ll receive your first payout after your account is verified, products are sold, and reserve periods (if any) are met.

The StarterX Team is a group of e-commerce experts with years of hands-on experience in launching, managing, and scaling online businesses. As trusted authorities in the e-commerce space, we’ve helped entrepreneurs grow successful stores on Amazon, Shopify, TikTok, and Walmart. Backed by real-world results and a data-driven approach, we deliver proven strategies and insights you can trust to succeed in the digital marketplace.